Transactions |

Bookrunner

£1.5m placing and subscription

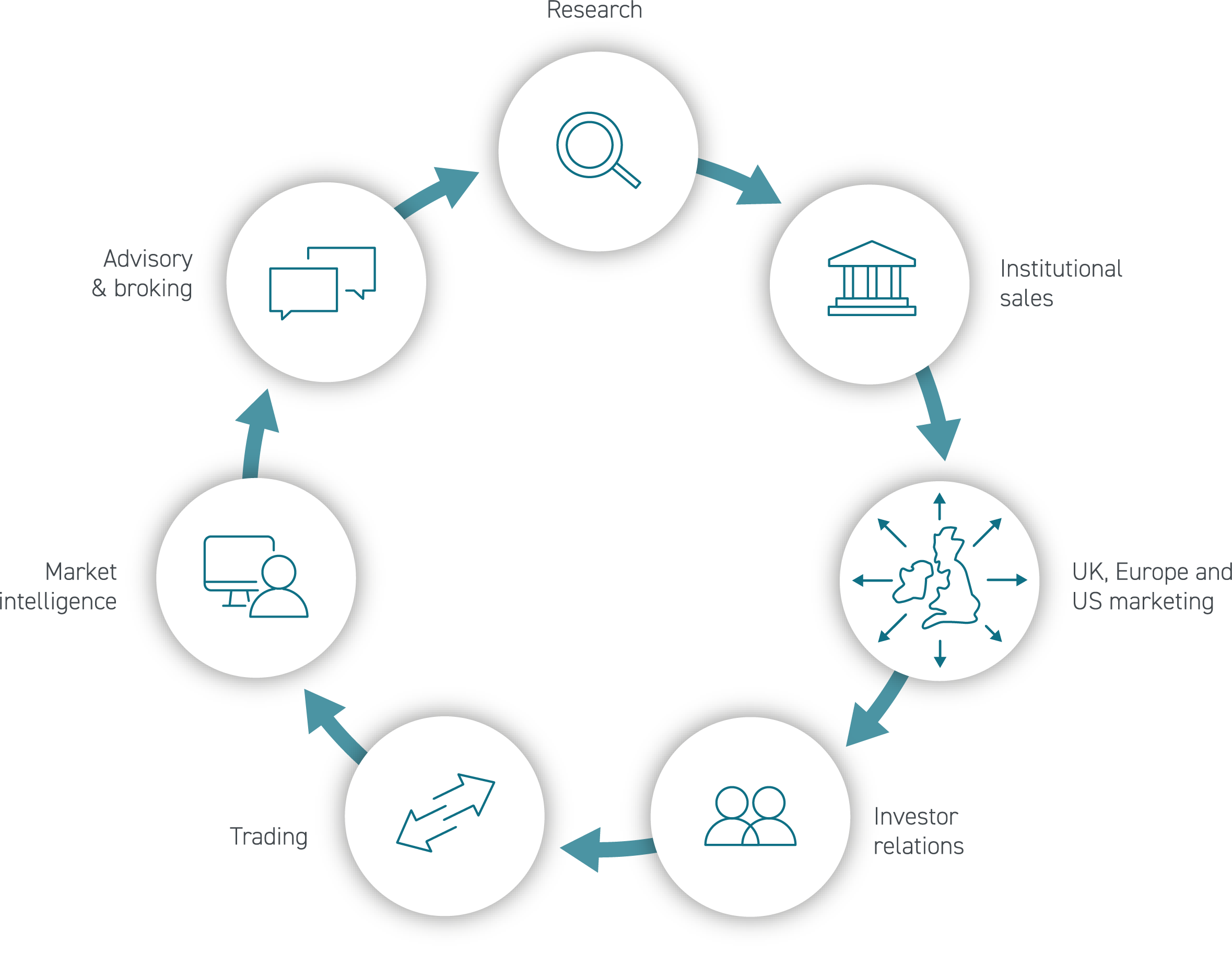

A UK based independent financial services business with a very successful leading edge electronic equities trading platform, which operates alongside a highly rated and growing equity capital markets division.

Raised for clients in 2021-2023

Number of corporate clients

Number of stocks we make a market in

Portfolio managers receive our research

Transactions |

£1.5m placing and subscription

Transactions |

£3.7m conditional placing and subscription

Transactions |

£9.9m conditional placing and subscription

Appointments |

Nomad and Joint Broker

Appointments |

Nomad and Sole Broker

Transactions |

£100m Recommended Cash Offer by Cerezzola Ltd.

Transactions |

£23.5m Recommended Cash Offer by Rotala Group Limited

Appointments |

Nomad and Sole Broker

Appointments |

Joint Broker

Transactions |

£99m Recommended Cash Offer by CoStar Group

Appointments |

Joint Broker

Appointments |

Nomad & Joint Broker

Transactions |

£17.8m Recommended Cash Offer by Genesis BidCo

Transactions |

Placing, Retail offering and Open Offer to raise £6m

Transactions |

£6.1m Conditional Placing & Open Offer of up to £2.9m

Transactions |

£214m offer by Cap10 Partners

Transactions |

£9m Tender Offer

Transactions |

£8.64m Tender Offer

Transactions |

£6.1m Fundraising

Transactions |

$1.7bn Takeover