Appointments |

Mkt Cap £317m

Joint Corporate Broker

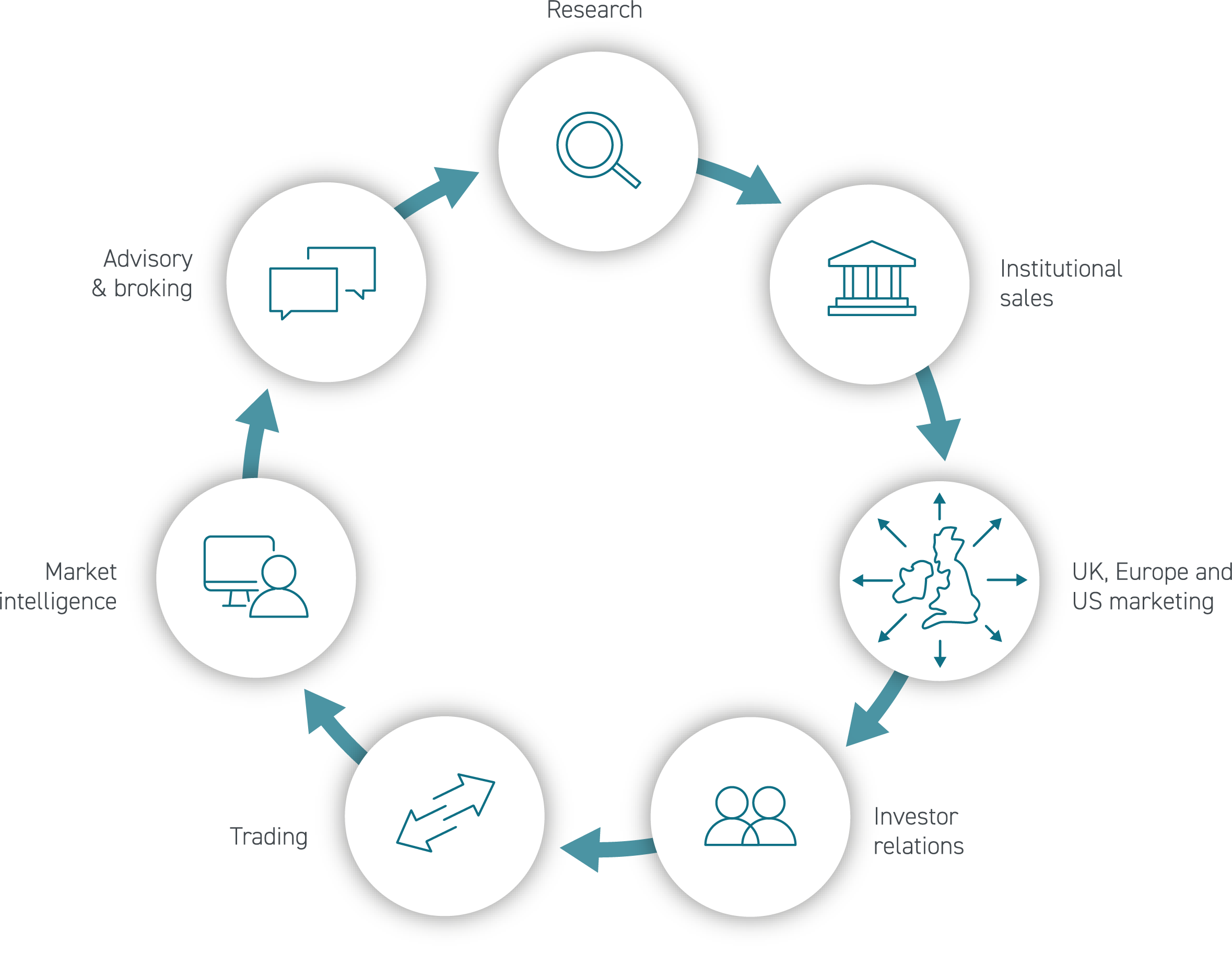

Shore Capital Markets

Connecting ambition with opportunity

Number of corporate clients

Number of stocks we make a market in

Subscribers receive our research

Appointments |

Joint Corporate Broker

Transactions |

c.£1.49bn Acquisition of Bakkavor Group

Appointments |

Joint Corporate Broker

Transactions |

Initial Public Offering with £60m market cap and £11.2m placing of new shares

Appointments |

Nominated Adviser and Sole Corporate Broker

Appointments |

Joint Corporate Broker

Appointments |

Financial Adviser and Sole Corporate Broker

Appointments |

Nominated Adviser and Sole Corporate Broker

Transactions |

Initial Public Offering with £205m market cap and £40m placing of new shares

Transactions |

£167m Recommended takeover by Laumann Group

Appointments |

Financial Adviser and Joint Corporate Broker

Transactions |

£183.6 million recommended takeover by Intrepid Bidco Limited

Transactions |

£297 million recommended cash acquisition by FirstCash

Transactions |

Acquisition of a majority stake by Finsbury Food Group

Appointments |

Corporate Broker

Appointments |

Sole Financial Adviser and Corporate Broker

Transactions |

US$4m Fundraise

Appointments |

Sole Corporate Broker

Appointments |

Nominated Adviser and Sole Corporate Broker

Transactions |

£1.02m Placing